Activewear Market Trends for 2023

Activewear Market Trends for 2023

The activewear market has seen exponential growth over recent seasons and continues to be appealing for its high profit potential and consumer appeal.

The sportswear market is one of the hottest markets for growth over the next 10 years. It is expected that the activewear market will grow from USD 170.94 Billion in 2021 To USD 267.61 Billion in 2028.

The global M&A apparel market saw three $1bn-plus M&A deals in Q3 2021, compared to just one in the previous quarter. The apparel sector registered the highest growth in Q3 2021 in terms of both deal value and deal volume.

Although domestic deals continued to dominate in terms of deal volume, cross-border M&A deal value and volume recorded growth in Q3 2021 compared to the previous quarter.

M&A activity in the apparel sector has accelerated since the pandemic, as brands which were failing to keep up with changing consumer trends became even more vulnerable and required help to survive.

The changing nature of shopping, as customers move online for their purchases, will lead to increased importance of these partnerships, both with other apparel companies and suppliers. This will help to make businesses more efficient and will help them save on costs, thus bolstering profits.

The athleisure trend, which has been growing since the 2010s, is a style of clothing in which items are designed to be worn both during exercise and for general day-to-day wear. These include yoga pants, joggers, or leggings as well as t-shirts that can be worn in the gym but also outside it.

The biggest benefit of athleisure is comfort: both physical and psychological. However, with the rapid growth of athleisure comes the challenge of styling athletic garments in ways that are suitable for casual settings as well as the gym. During and after the pandemic, activewear is now a main apparel for everyone so the market is wide open.

Many online retailers have also reported a rise in sales of activewear as consumers look for ways to stay positive during the pandemic. However, the question is if this is an irreversible trend. Fashion has evolved to more and more casual over decades. With people gradually returning to the office, the activewear boom will be balanced with the need for appropriate work clothes that are both comfortable and fashionable.

Part of the change was attributed to beginning of going back to the office / hybrid setting and maybe some “fatigue” from wearing yoga pants and sweatshirt every day. For sure, the demand for comfort will inform the more formal and elegant offering.

Here’s the problem: While the world has slowed down, the fashion industry has sped up. Brands are churning out new activewear styles that keep up with our changing needs. But that has added to overproduction and waste.

Now, fashion brands have come under increased pressure to reduce their environmental impact as customers seek out more sustainable options.

To reduce waste, brands have moved toward creating unisex designs that can be worn by anyone regardless of their gender identity. This has also helped increase the range of sizes available. Other companies have introduced rental programs where customers can rent pieces instead of purchasing them outright. And sustainable initiatives like these will only multiply in 2022.

The apparel and footwear market are packed with high-profile acquisitions because legacy brands are looking to expand their reach into fast-growing markets. The already lucrative category is well on its way to accounting for $547 bn globally by 2024.

The pace of mergers & acquisitions picked up in 2021 after a pandemic-restrained year in 2020. Among the major brands and stores that found new owners were Beyond Yoga, DTLR Villa, Eddie Bauer, Hey Dude, Imperial Headwear, JackRabbit, Neptune Mountaineering, Osprey, Reebok, Spanx, Sportsman’s Guide, Sweaty Betty, TaylorMade, and WSS.

With the M&A market heating up, there are certain key factors that make a deal worthwhile. According to experts and analysts, is situated in a fast-growing category, such as activewear and athleisure, which is a green flag to a larger company looking to expand its portfolio.

According to a July 30 report from The NPD Group Inc., activewear sales increased more than 40% in the first half of 2021 compared with last year, and more than 25% compared to 2019.

“It is clear that activewear is the key apparel story in 2021,” said Matt Powell senior sports industry adviser for NPD. He also noted that the top-performing active brands are the ones that have focused mostly on female consumers, a major sector of opportunity for brands looking to grow.

In the case of Wolverine, acquiring Sweaty Betty gave the shoe giant a stake in the fast-growing and competitive women’s activewear category, which is led by high-growth brands like Lululemon.

In a recently published Similarweb report, the 25 fastest-growing activewear brands according to web traffic included many smaller and women-focused brands such as Modli and Halara. At the same time, legacy brands Teva, Speedo, and Skechers were also represented.

“The focus on health and wellness is here to stay,” said BMO Capital Markets Analyst Simeon Siegel. “As such, it’s fair to assume brands that resonate strongly with their customers will continue to grow, whether as a standalone and as an acquisition target for a larger company looking to capitalize on the structural shift to active.”

He added that brand acquisitions can either help companies enter the “athletic conversation” or can bolster an existing presence in the market with new products, as was the case with Lululemon’s acquisition of Mirror.

Beyond being situated in the activewear market, brands with strong digital capabilities and existing infrastructure are more likely to be targets for larger brands, experts said.

“Outside of accessing funds and assets, acquisitions could help companies acquire relevant capabilities such as skillsets/knowledge, wider customer segments, proprietary designs or processes versus starting from scratch,” said Liza Amlani principal and founder of Retail Strategy Group, a consulting company for retailers. “In some cases, merging with another brand could increase a brand’s market share and cut out some of the competition.”

Amlani added that smaller brands with inclusive offerings for all sizes can also entice larger brands looking to penetrate these categories.

CDI Global has working in the fashion mergers and acquisitions sector for decades and can offer support and guidance when you’re ready.

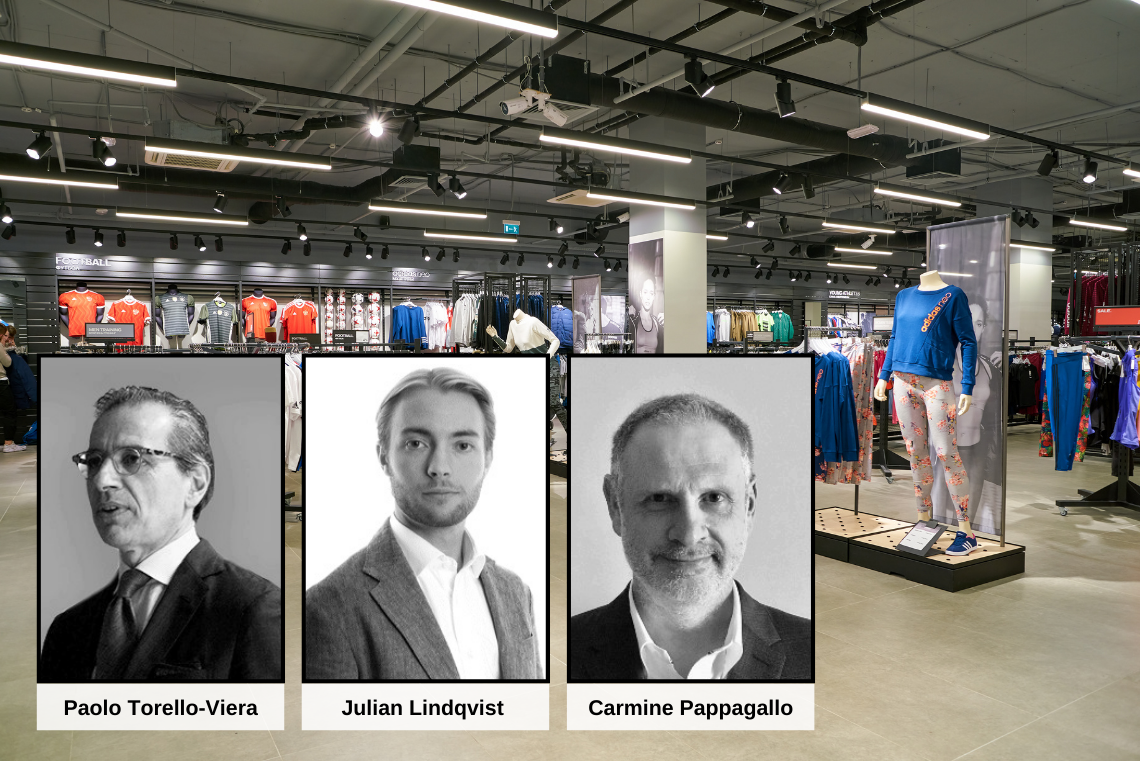

By: Paolo Torello-Viera, Julian Lindqvist and Carmine Pappagallo